Auction Dispatch: May 2025 Edition

A data-driven look at the performance of the Marquee week auction sales in New York. It includes notes on what performed well, where value was found and what read-throughs we see for market sentiment.

A belated good afternoon to everyone — Since my last note, I’ve crisscrossed Venice, Lake Como, and the Cote d’Azur scouting wedding venues, cheered my sister’s graduation in Philadelphia, flitted between New York’s fairs and auction rooms, and now I’m bound for London tomorrow to toast my mother’s perpetual twenty-ninth birthday. Needless to say, I’m running on fumes, so today I'm returning to my comfort zone – the spreadsheet.

This is your dispatch of May’s marquee evening sales at Sotheby’s, Christie’s and Phillips. These auctions are the art market’s biggest event — three nights each in May (and again in November) when blue-chip works and storied collections exchange hands under the glare of the world’s keenest art investors.

These sales don’t merely set prices; they distill the zeitgeist of taste and capital into a single, unforgiving number: the hammer. Behind each bid lies a wager on cultural prestige, portfolio performance, and economic confidence. In other words, if you want to know how deep collectors’ pockets really are—and where the market is heading—this is your scoreboard.

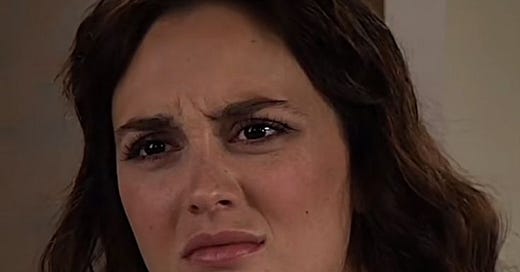

But what really happened? Behind the glitz and headlines, top-tier works barely nudged their estimates, while more affordable lots—those under $200,000—consistently sold. The wealthiest bidders hung back on marquee names, but active collectors snapped up midrange pieces with excitement.

In practice, the market’s heartbeat came not from blockbuster hammers but from hundreds of these quieter, six-figure sales. That steady drumbeat—not a single headline—reveals where the real momentum lies.

The Methodology

I tracked the sales, watched them live, and ran my own analysis—back to my quantitative roots. I calculated hammer prices, matched them against published totals, and, for sport, estimated the fees paid to successful irrevocable bidders (IBs), the kinds I used to structure back in my auction house days.

So, while this may be a less salacious read than the articles relishing in the audible gasp that followed the Giacometti buy-in at Sotheby’s, it’s far more instructive—particularly for anyone trying to read where the market is going rather than just react to it.

The Takeaways

Without further ado, here are my three big takeaways from the May 2025 Evening Sales:

1. Personal Taste is Back in Vogue

The three white-glove single-owner sales—Riggio at Christie’s, Im Spazio and Gladstone at Sotheby’s—aren’t just triumphs of provenance, they’re a statement about curation.

These are auctions devoted entirely to a single collection — this season included the Riggio sale, the Gladstone sale and the Im Spazio sale, each with its own illustrious provenance. Riggio is the collection of masterworks owned by the Barnes and Noble founders, Leonard and Louise Riggio, sold at Christie’s; Gladstone is a collection of 12 highlights from the home of legendary art dealer Barbara Gladstone, who recently passed. Lastly, Im Spazio is a collection of 15 works sold at Sotheby’s that belongs to notable gallerist, dealer and advisor Daniella Luxembourg focusing on artists from Europe and America that refused to be confined to the planes of a canvas - exploring space and volume in groundbreaking ways.

“White-glove” means every lot sold, no exceptions. In an era of caution, that’s a telling indicator: buyers are voting with their wallets for fresh, tightly edited offerings rather than works that have circulated the block multiple times.

So what is the read-through here? Scarcity as Strategy.

These single-owner sales were tightly dialed: high-quality suites of works, offered as cohesive bodies that had not been seen by the market recently. Buyers snapped them up not just for the strength of the art, but because they knew this was a one-off opportunity—not a lineup that would repeat itself next season.

2. Buyers are Looking for Freshness and Novelty

But beyond the headline acts, the broader market tells the same story: “first-to-market” works are commanding outsized attention. Female artists and emerging voices—many at auction for the first time—saw hammer prices leap ahead of estimates, while established blue-chip works making repeat appearances underperformed. A few notable examples of this out-performance:

Emerging Artists Causing Excitement: Danielle McKinney’s The Fool (first time on the block) - hammered at $165k against a $50k estimate, underscoring how collectors will pay a premium for novelty and narrative. Yu Nishimura’s Across the Place (fresh to market, backed by a new gallery partnership) - bid to $320k on a $50k estimate—another that names with primary market interest can become market sensations overnight.

Female Voices Rising: Works by rising female artists without prior auction records outperformed familiar names by 20–35% on average, signaling a hunger for under-the-radar talent rather than the usual cast of blue-chip stalwarts.The biggest showstopper for me was the spectacular performance by Olga de Amaral’s work at Phillips selling for >300% of the low estimate.

Even old faithful artists had good results, provided the works were fresh to the market: At Sotheby’s, Lichtenstein lithographs sold at or above estimate, with five evening pieces even eclipsing their high estimates, likely buoyed by buzz around his upcoming Whitney retrospective. And Warhol’s Flowers traded at two to three times their low estimates, proving that rarity can still steal the show—even without a flashy headline.

In short, the market’s message is clear: curation and novelty beat recirculation. Buyers are discerning, and they’re eager to back emerging narratives over reheated classics.

For the right price…

3. Value-Seeking Behaviour & the “Hard Ceiling”

Speaking of caution in the current environment we saw a lot more “value-seeking behaviour” in the bidding this season.

You saw this in four different ways:

“Hard Ceiling” Intact – As observed by Wall Power, "Good works are selling, but there's a limit to how high prices will go.” Even works where the stars have aligned to show spectacular auction results couldn’t break the confines of their estimate ranges. Works by Cecily Brown, Sherrie Levine and Yayoi Kusama, all of which in a frothier market would outperform, had bidding "peter out a little above the estimate". This indicates a market where buyers are cautious and unwilling to push prices significantly beyond predetermined limits.

Polarized Momentum – Real activity clustered in the bottom quintile, where sub-$200k works found eager bidders and drove market volume. Whereas, many marquee works stalled below reserve or were bought in, underscoring a “hard ceiling” once pieces breach the $15M–$20M mark.

Beware the $200k Threshold – Once estimates exceed about $200k, hammer-to-estimate ratios collapse to ~0.87, signaling that many lots in this range are seen as too expensive to have attractive upside, and too risky to be considered a store of value. Think about the risk-return tradeoff you can get with $200k in other investments, these lower liquidity, pretty speculative paintings aren’t doing it for bidders.

Editions as Safe Havens – All nine Roy Lichtenstein estate editions at Sotheby’s sold at or above estimate—proof that editioned works offer bond-like reliability when appetite for risk wanes. validating a market pivot back to historical names and suggesting that editioned works remain reliable storehouses of value. In a world of risk off, editions are the luxury equivalent of government bonds.

Overall, what is the read-through for the general market? The broader economic climate significantly influenced market sentiment. Wealthy bidders are fully aware that the economy could get much worse, with concerns stemming from slow economic data and high-profile advice, such as Ken Griffin's suggestion that staying in cash might be best. Read: highly liquid, out of the market.

The upshot? Top-tier buyers have swapped bravado for brinkmanship. Rather than sparking bidding wars, they’re running the clock, sizing up risk right to the buzzer. In this climate, every hammer fall feels less like a triumph and more like a cautious nod: “We’ll take it, on our terms.” The broader market read-through is clear—risk aversion reigns.

STYLE | ART | GROW | GO nyc based. paris grown. https://morganebensadoun.substack.com/p/05-under-the-radar-brands-the-perfect